why is pfizer stock so cheap

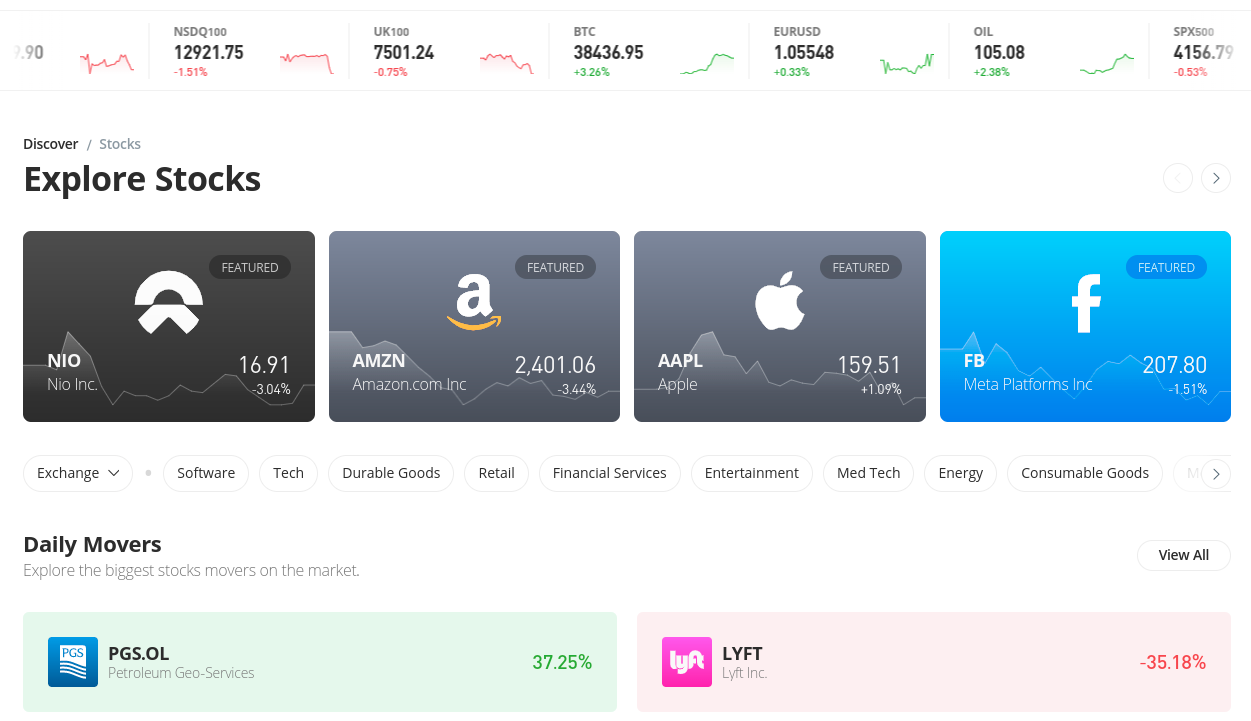

First T stock is down big this year off 273 in 2020 while the SP 500 is up 155. LightRocket via Getty Images.

Pfizer Stock Is Pfe Stock A Buy Or A Sell As Its Covid Vaccine Faces A New Lawsuit Investor S Business Daily

One reason to buy Pfizer stock is its lush dividend yield of 425 more than double that of the SP 500.

. Their PFE stock forecasts range from 4400 to 7600. They do have quite a few programs in clinical trials and a total of 20 developmental candidates. The stock spent much of the last half.

Now lets address it. Analysts recommendations show a 12-month targeted price. Volatility on Pfizer is very cheap.

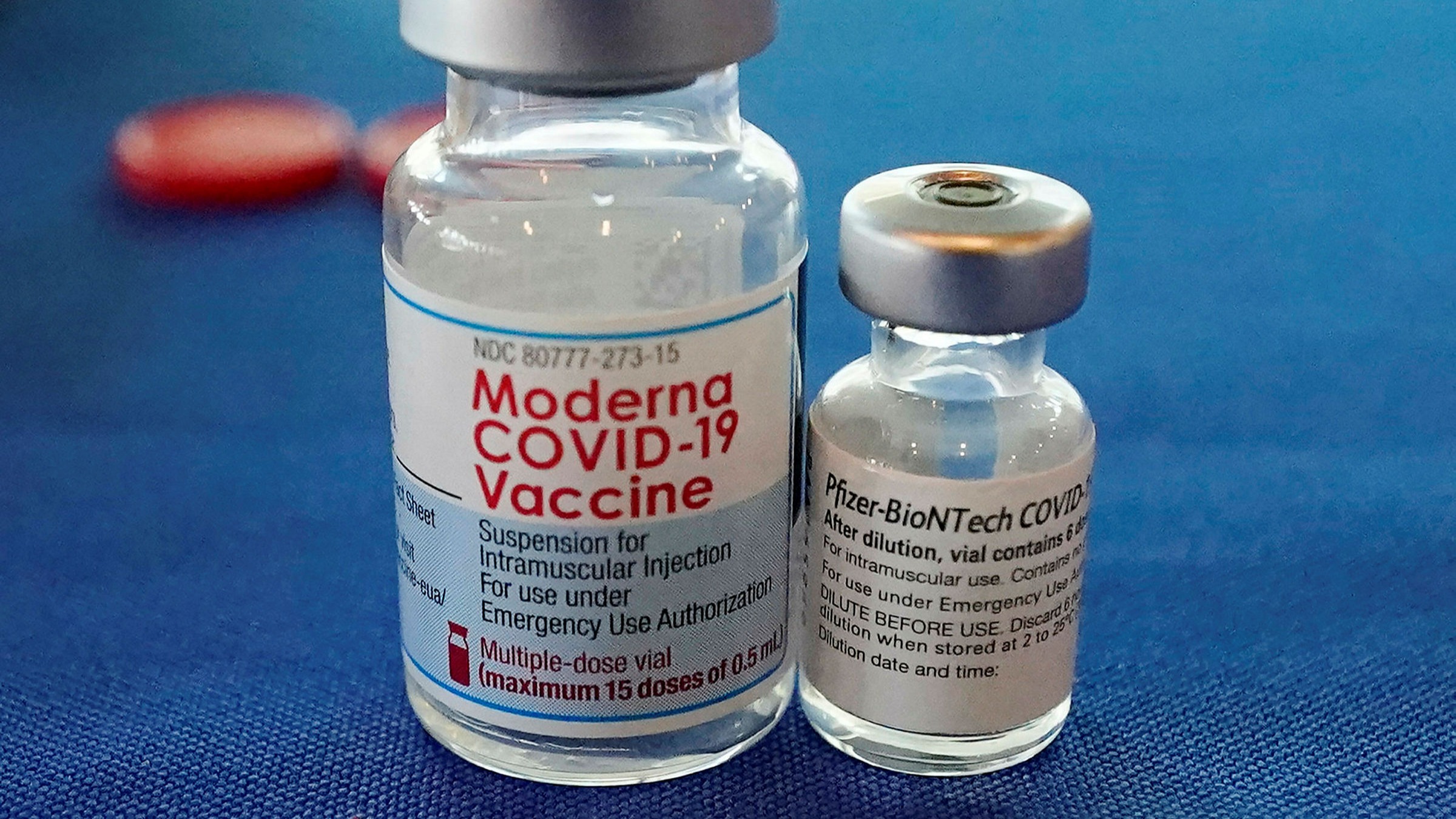

Modernas stock rose 28X in the past 2 years are these biotech picks next. The Pfizer stock has improved by nearly 44 in the last 12 months and the analysts estimate the stock has a potential to return 120. Pfizer PFE -023 recently announced very good first-quarter results.

This suggests a possible upside of 109 from the stocks current price. The big drugmaker even raised its full-year guidance. By headhe fundamentalists selling out and lowering it during massive market booms it makes private investors think it sucks and they sell their positions.

In the first quarter adjusted Pfizer earnings were 162 per share on. The company reported revenue of 2384 billion and adjusted earnings of 108 per share. In fact it hasnt been this cheap in a while.

Because it will be the one that creates the REAL vaccine. Answer 1 of 5. On average they anticipate Pfizers share price to reach 5726 in the next year.

Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report. However stock prices prices reflect the markets valuation of a company. Five Stocks That Will Define The Next Decade of Retirement.

A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans uncertainty over the need for Pfizers Covid. Pfizer NYSEPFE stock is cheap. However its share price barely moved.

Pfizer is very cheap much cheaper than most of the other vaccine stocks. Even if youre 100 convinced that you want to buy the stock you should understand why somebody is selling it to you at this price that youre willing to buy it at. Additionally implied volatility is.

Pfizer is a much bigger company with numerous meds on the market and others in the pipeline. Based On Fundamental Analysis. For example right now PFE stock trades for just 13 times expected EPS of 286 for 2020.

High volumes of covered call writing have beaten down options premiums. The stock spent much of the last half-decade since 2016 in the 30 to 35 range. So when it finally does pop there is more money to be made by big firms.

So all in all is PFE stock a buy. Revenue and profits soared. Second the company has now gone five quarters without raising its dividend.

The stock has ebbed and flowed roughly between the mid-20s to mid-30s for the last five years. To preface my explanation I will assume that you expected Pfizers stock to increase substantially after developing a vaccine for COVID-19. Moderna has no med that has been approved for distribution yet.

It is also only 116 times. Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory. PFE stock is basically flat over the past three years.

I think there are maybe three. Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042. Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory.

Ad Five Under-The-Radar Investments You Cant Afford to Miss. Its actually 11 from what I see on yahoo. Ad Our Strong Buys Double the SP.

This gives Pfizer shares a price-to-earnings ratio of around 11 which does indicate a cheap valuation. And finally it has a ton of debt weighing in at around 170 billion. The question however is why Pfizer stock seems so cheap.

There are innumerable inputs and metrics that go into these figu. 18 Wall Street research analysts have issued 1 year price objectives for Pfizers shares. After the success of the vaccine it is.

About that theres little doubt. So a few reasons why their pe is so low. Ad Biotech is becoming one of the best new sectors for investing if you know where to look.

Now lets address it. Why Is Pfizer Stock So Low. Answer 1 of 4.

Its a yield company as in their revenue is no longer growing so you are looking at it from a yield perspective and in this environment that means dividend as earnings is fairly volatile. Investors showed displeasure with the outlook and the stock drifted lower by. The stock has ebbed and flowed roughly between the mid-20s to mid-30s for the last five years.

It is cheap changing hands at a priceearnings ratio of just 144 at a time. PFE stock declined 4 from 39 in the beginning of this year to 37 as of April 24 compared to over a 10 decline for the broader SP 500.

How To Buy Pfizer Pfe Stock Forbes Advisor

Pfe Pfizer Inc Stock Overview U S Nyse Barron S

How To Buy Pfizer Stock Is Pfizer A Buy In July 2022

Dow Falls 900 Points For Worst Day Of Year On Fears Of New Covid Variant S P 500 Drops 2

Pfizer And Moderna Raise Eu Covid Vaccine Prices Financial Times

S P 500 Falls As Market Struggles To Recover From Multiple Weeks Of Losses Nasdaq Down More Than 1

How To Buy Pfizer Stock Is Pfizer A Buy In July 2022

How To Buy Pfizer Stock Is Pfizer A Buy In July 2022

Live News From January 10 Pfizer And Moderna Step Up Efforts On Omicron Targeting Vaccine Fed S Second In Command Resigns After Trading Scandal Us And Russia Extend Talks Over Ukraine Crisis Financial Times

Pfizer Inc S Nyse Pfe Stock Is Going Strong Have Financials A Role To Play

Here S What We Like About Pfizer S Nyse Pfe Upcoming Dividend

:max_bytes(150000):strip_icc()/4-6d6ad667049442be82eba9859b909770.jpg)

Pfizer Positioned For Future Upside

Moderna Pfizer Stocks Fall As Covid Omicron Wave Subsides In U S

News Updates From November 5 Pfizer Reveals Upbeat Trial Results For Covid Pill Pelosi Vows To Press Ahead With Vote On Infrastructure Bill Ba Owner Warns Of 3bn Loss In 2021 Financial Times

:max_bytes(150000):strip_icc()/3-3a4c5d6eab9c47f9a0cca1daa0f78c42.jpg)

Pfizer Positioned For Future Upside

The Inside Story Of The Pfizer Vaccine A Once In An Epoch Windfall Financial Times

How To Buy Pfizer Stock Is Pfizer A Buy In July 2022

:max_bytes(150000):strip_icc()/1-d656e003d5bb4c5f849f55b3e2b4deb6.jpg)

Pfizer Positioned For Future Upside

Pfizer And Moderna Raise Eu Covid Vaccine Prices Financial Times